Homeowners Insurance in and around Sugar Land

Looking for homeowners insurance in Sugar Land?

Help cover your home

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help protect your home in case of fire or blizzard, but it can also be beneficial in specific legal situations. If someone were to hold you financially accountable if they had an accident on your property, the right homeowners insurance may be able to cover the cost.

Looking for homeowners insurance in Sugar Land?

Help cover your home

Agent Steve Yang, At Your Service

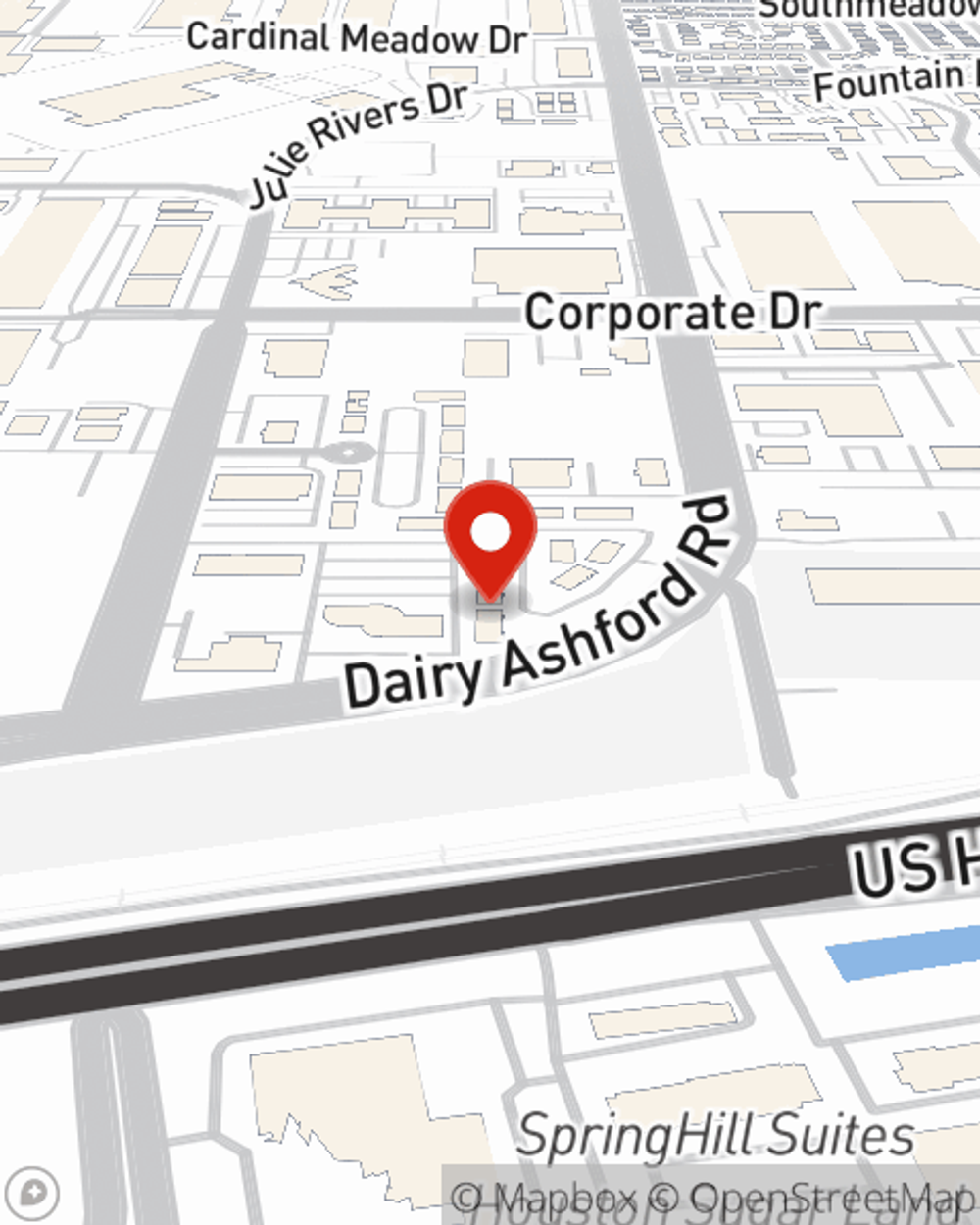

That’s why your friends and neighbors in Sugar Land turn to State Farm Agent Steve Yang. Steve Yang can explain your liabilities and help you choose the right level of coverage.

For exceptional protection for your home and your keepsakes, check out the coverage options with State Farm. And if you're ready to get the ball rolling on a home insurance policy, visit State Farm agent Steve Yang's office today.

Have More Questions About Homeowners Insurance?

Call Steve at (832) 999-4966 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.